Will your company be able to lower salary costs by half while the employee retains 90% of the salary?

On March 16, the Swedish Government presented a proposal for new rules on so called temporary short-time work. The rules allow an employer to reduce its costs for an employee by more than 50% (up to a salary cap of SEK 44,000 per month and employee), while the employee retains more than 90% of the salary.

In short, the rules are as follows.

− An employer can agree in writing with the labour union counterpart (if the employer is bound to a collective bargaining agreement) or with at least 70% of the employees in the operating unit (if the employer is not bound to a collective bargaining agreement) for a temporary reduction of 20, 40 or 60% of the regular working hours.

− The Swedish Government, through decision from the Swedish Agency for Economic and Regional Growth (Sw. Tillväxtverket) (the “Agency”), reimburses about three quarters of the cost for the employees’ reduced working hours. The employer’s costs can thus be reduced by up to 53%, while the individual employee can retain over 90% of the salary.

− The new regulations will come into force on April 7, 2020 but will be implemented as of March 16, 2020 and throughout the remaining year. The application will be made through the website tillvaxtverket.se and will be available on 7 April. Consequently, no support will be able to be sought or obtained until April 7. How and when the support will be paid, in practice, remains unclear.

Prerequisite for the support

In order to receive the support, certain criteria according to the Act (2013: 948) on support for short-time work must be met, by both the employer and the employee. Among other things, the following must be fulfilled.

− The need for short-time work must have arisen because of temporary and serious financial difficulties beyond the employer’s control. A guiding principle for when the difficulties are “serious” is that the need for shortening working hours should cover one third of employees when the working time reduction is 20% (or 1/6 with 40% etc.). Nor should the difficulties have been foreseeable for the employer.

− Other measures to reduce the cost of labour shall have been exhausted. Such measures may include the implementation of changes in shift planning and termination of employees who are not permanently employed and who are not deemed to be business-critical, e.g. consultants or temporary employees.

− The working hours reduction must be either 20, 40 or 60%. No other degree of work reduction will be accepted.

− Support is granted only to employees who have been employed during part of or the entire month that falls three months before the Agency’s decision on support, with the same or higher employment rate as during the support month.

− Support cannot be provided for short-time work attributable to an employee’s notice period.

− Support is not provided for employees belonging to the employer’s family.

− Support is not provided to employers who at the time of application are in technical liquidation as defined in the Swedish Companies Act, are subject to corporate restructuring or are insolvent.

− As a general rule, support is provided for a maximum of six months. After admitting a second application, the support may be extended for another three months.

− If the employer is bound by a collective bargaining agreement, an agreement is required both between the central parties, i.e. between the employers’ organisation and the labour unions, and the local parties, i.e. between the employer and the local labour union club.

− If the employer is not bound by a collective bargaining agreement, a written agreement with at least 70% of the employees at the individual operating unit is required. The working hours and salary reductions that have been agreed shall be the same for all participating employees in the operating unit.

The remuneration is based on ordinary salary, which is defined as “the regular salary that the employee would have recieved during the support month if he or she had not participated in short-time work” up to a maximum level of SEK 44,000 per month.

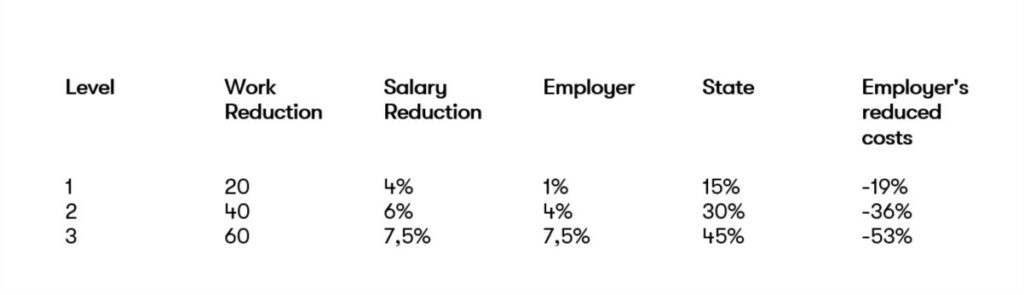

The below table shows the cost allocation in case the support is granted:

In summary, the possibility to receive the support for temporary short-time work is likely to be an attractive solution for many employers and employees. However, there are several uncertainties that need to be considered. Apart from the fact that we do not have any formal legislation in place yet, it is not entirely clear how the assessments of the right to support will be made. For example, it is difficult to determine in advance whether one is deemed to have “exhausted other measures”.

For companies that want to apply for support for short-time work, it is important to take these risk factors into account before any agreements are made with employees/labour unions or the application is submitted to the Agency, especially since the support is likely to be provided by 7 April 2020 at the earliest.

How to seek the support? So far there are few details on how the support will be administered in practice. Therefore, one can expect that the Agency will shortly provide further information on how to proceed. Therefore, keep an eye on the Agency’s website.

What we already know is the following.

The support is sought at the Agency, via tillvaxtverket.se. At the earliest, the support can be applied for on April 7, 2020, although it is possible to receive support in respect of salary relating to the period from March 16, 2020.

The support can be provided to you as an employer after approval by the Agency. If you have received an approval, you can apply for preliminary support for an initial period of no more than six months. If the financial difficulties remain, the time period may be extended by three additional months. The first month of support must fall within 45 days of approval of the support. Otherwise, support cannot be provided.

An application for an extension of the support must have been received by the Agency within four calendar months from the start of the support period of six calendar months.

It is the employer who must show that it is entitled to support. It is therefore necessary to state, in the application, among other things, a clear basis for having been in temporary serious financial difficulties.

The support that is paid out is preliminary. When provisional support has been provided, reconciliation shall be made at the end of the third calendar month from the start of a support period and thereafter every three months from the first reconciliation date. The reconciliation involves a comparison and assessment of whether the average working hours and salary reductions applied are in accordance with the specified levels in the law and the agreements that have been concluded.

If the actual working time differs from the basis on which the support is based, the employer may be required to repay the support.

A notification of reconciliation must have been received by Agency within two weeks of the reconciliation date. In the notification, the employer must indicate whether it is obliged to repay an amount after a compilation. If it is entitled to further support, this must be requested in the notification of reconciliation. Unless a notice of reconciliation is filed in due time, the employer will be required to repay all preliminary support.

You can find our guide in full text here in Swedish and English respectively.

The development of the coronavirus outbreak is uncertain and we receive new information on a daily basis.

The content of this article reflects the situation at the time it was published March 23, 2020 and is subject to change.